26+ Lvr calculator margin loan

Compare Fixed Home Loans. One year is assumed to contain.

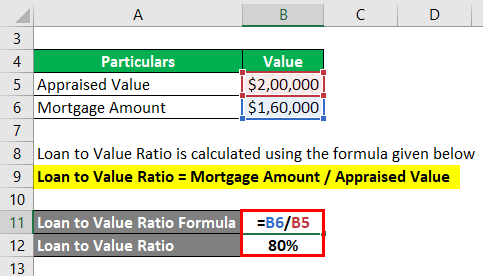

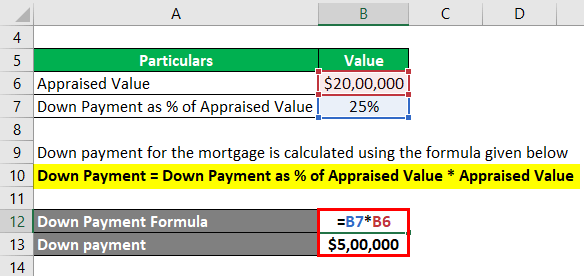

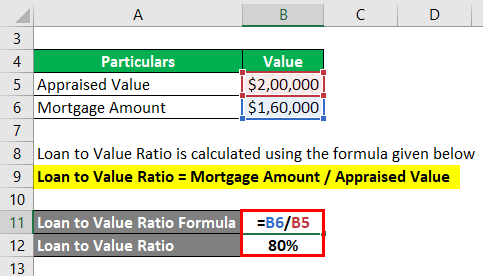

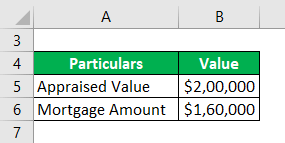

Loan To Value Ratio Example Explanation With Excel Template

Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee calculator Fix or float calculator Credit card real cost Real cost of debt Retirement calculator All our.

. Offer for residential investors principal and interest LVR. Offer for new owner occupier loans when making principal and interest repayments LVR 80. Loan to Value Ratio LVR compares the amount you have owing on your loan against the actual value of your property.

Home Loan comparison rates are based on a loan of 150000 for a term of 25 years repaid monthly. One year is assumed to contain exactly 52 weeks or 26 fortnights. Car Loan Calculator Term Deposit Calculator Credit Score Rate Checker Home Loan Eligibility Checker.

LVR is the amount of your loan compared to the Banks valuation of your property offered to secure your loan expressed as a percentage. Basic Home Loan Promotional Principal and Interest Rate. A two-stroke engine vehicle with two cylinders and 26 horse powers.

Car Loan Calculator. This amount may not be the final amount you need to re finance your property and is used solely for the purpose of providing you with an indication of the loan amount you may require the upfront costs you may. Home loan rates for new loans are set based on the initial LVR and dont change because of changes to the LVR during the life of the loan.

ME Bank have won Best Value Basic Home Loan - Bank Category for our Basic Home Loan product. Depending on the size of your loan interest rate movements and loan terms these fees can easily be thousands of dollars. The loan term represents the length of time it will take to repay the loan in full with a regular repayment schedule.

That is how efficient socialist governments. This offer is only available for new Owner Occupier Basic Home Loan applications with Principal and Interest repayments received from 25082022. We may change or withdraw any discount or margin at any time.

LVR stands for the initial loan to value ratio at loan approval. A competitive variable rate home loan with low-interest rates no monthly or annual fees and the ability to make interest only repayments. The biggest decline has been in Wellington City where the average swelling value has declined by 130000 in just the last three months with suburban areas such as Porirua and the Hutt Valley recording 7 to 9 declines over the same period.

Home loan rates for new loans are set based on the initial LVR and dont change because of changes to the LVR during the life of the loan. If you choose to make changes to your loan agreement during this time for example choosing to break out of a fixed rate home loan early then you may be subject to costs such as break fees. For example if your property was valued at 400000 and your loan amount was 340000 your LVR would be 85.

Home loan rates for new loans are set based on the initial LVR and dont change because of changes to the LVR during the life of the loan. The loan amount has been calculated based on the information input by you and information sourced by third parties. LVR stands for the initial loan to value ratio at loan approval.

This implicitly assumes that a year has 364 days rather than. You wont believe the incredible savings ME has on offer. A longer-term loan will usually attract a higher interest rate and the loan will cost you more overall but.

According to QV what its describing as a housing market correction is now starting to bite across most of the country. 7001 - 80. Calculate your home loan repayments with our handy home loan repayment calculator.

Calculate geared vs ungeared portfolio costs and returns by using our Margin Lending Calculator Important Information to Note. In Australia lenders offer terms from 6 months to 7 years with 3 and 5-year terms being the most common. Data shows that Queensland is the nations number one beneficiary of interstate migration by a considerable margin.

LVR is the amount of your loan compared to the Banks valuation of your property offered to secure your loan expressed as a percentage. In simple terms lots of people are vacating Sydney and Melbourne and many of them are heading north.

2

Loan To Value Ratio Example Explanation With Excel Template

2

Loan To Value Ratio Example Explanation With Excel Template

2

Loan To Value Ratio Example Explanation With Excel Template

2

2

Loan To Value Ratio Example Explanation With Excel Template

2